The pending crisis in financing public health care in Japan was projected to hit around 2022 as the bulk of baby boomers generation will join the ranks of the elderly, but has come sooner than expected due to the COVID-19 pandemic.

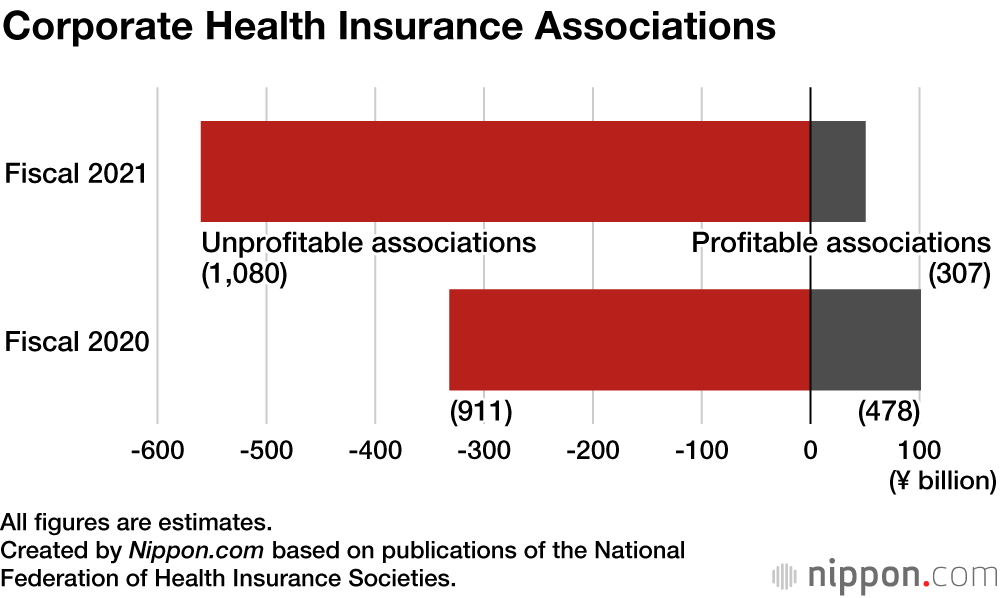

Estimates by the National Federation of Health Insurance Societies indicate that the COVID-19 pandemic is accelerating Japan’s health insurance woes. In fiscal 2021, a whopping 1,080, or 78% of the nation’s 1,387 health-insurance unions composed of employees of large companies, are expected to post deficits.

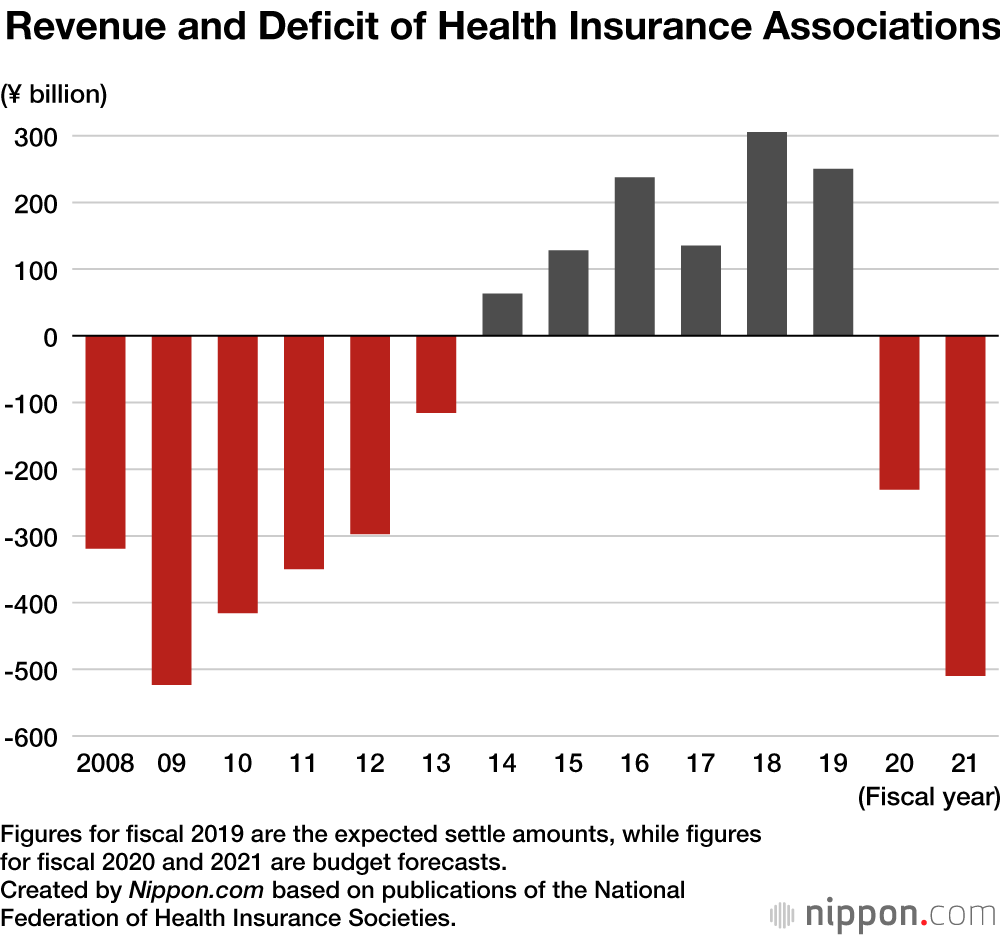

During the pandemic, revenue from insurance premiums have fallen year on year by 2.6% to more than ¥8 trillion. This revenue, which is connected to employee salaries and bonuses, fell sharply in industries like hospitality, food-service, retail, and entertainment that have been severely affected by the spread of the coronavirus. Meanwhile, the trend toward higher health-care expenditures continues as Japanese society ages. The current account balance shows a deficit of ¥509.8 billion, twice the deficit of ¥230.6 billion incurred the previous year.

The situation has forced many health insurance associations to raise premiums to cover shortfalls. The average rate in real terms, which reflects the difference between revenue and expenditures after raising premiums, rose year on year by 0.35 percentage points to 10.6%, marking the first time it has exceeded 10%. The average premium rate is 10% for the Japan Health Insurance Association, composed of employees of small and medium-sized businesses. Experts warn that if the upward trend continues, the added financial pressure on health insurance associations will cause some to fold.

(Translated from Japanese. Banner photo © Pixta.)