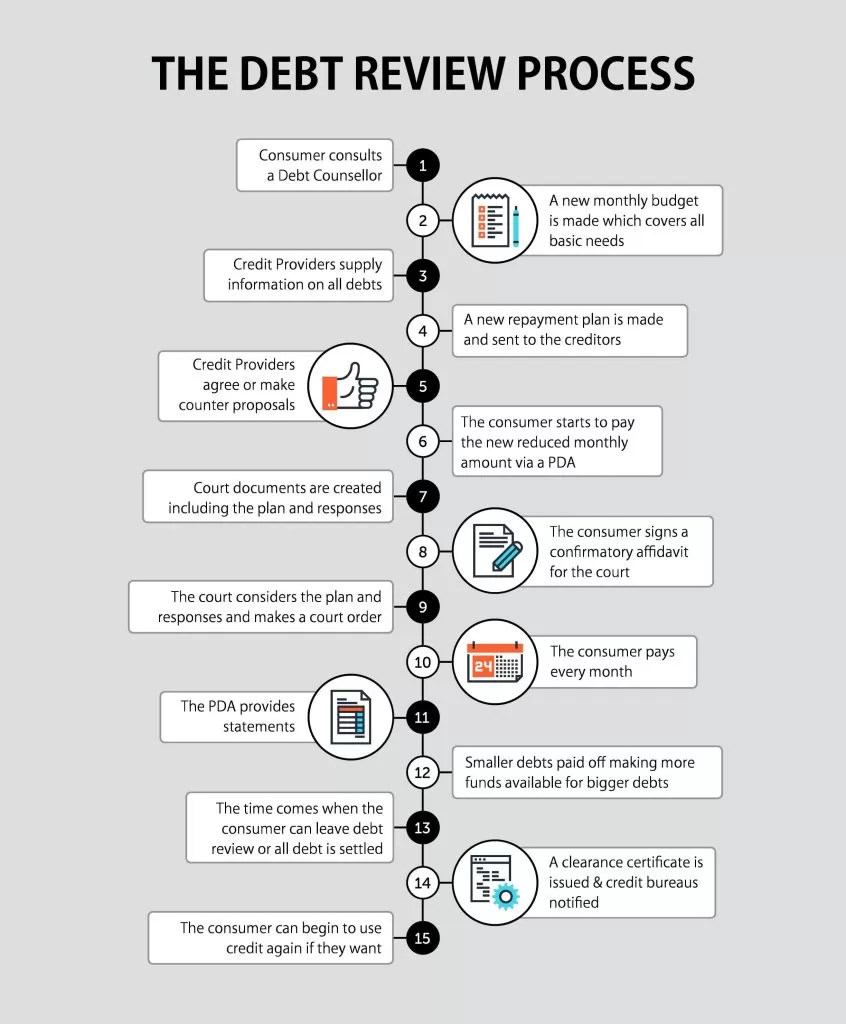

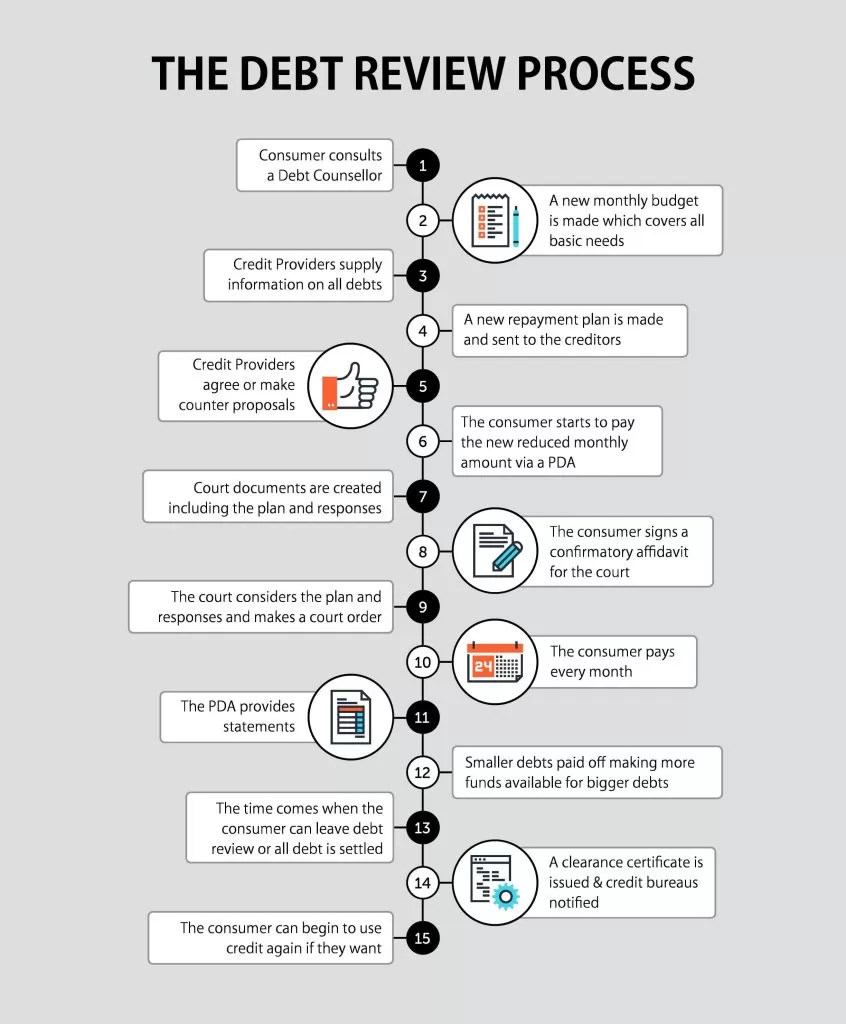

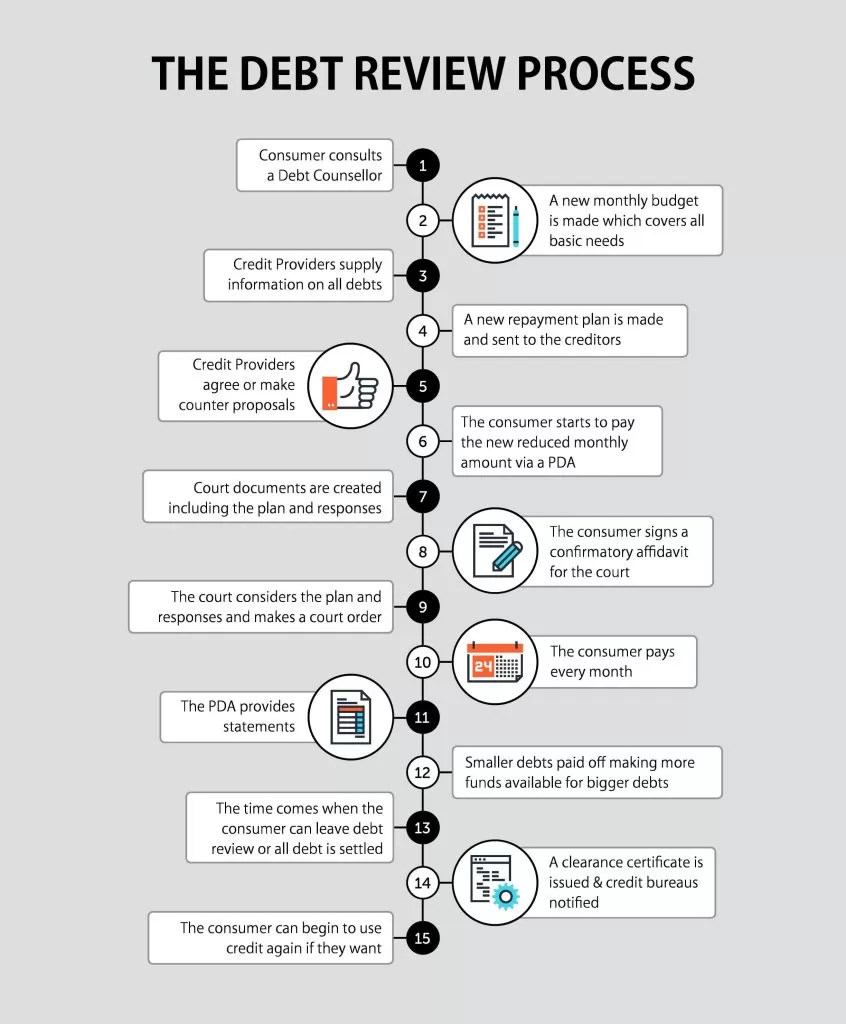

The Debt Review Process

In practise, a consumer will usually consult a Debt Counsellor when he or she realises that he or she cannot meet his or her monthly obligations. In other instances, the consumer who has defaulted on payment on a particular credit agreement may receive a letter in terms of Section 129 of the Act from the credit provider that informs him/her of the default and refers him/her to, amongst others, a debt counsellor.

Upon enquiry the following information must be conveyed to the consumer.

The purpose of debt review:

To assist an over-indebted consumer or a consumer who is not currently over-indebted but is experiencing or is likely to experience difficulty in meeting all his obligations under or her credit agreements in a timely manner. The Debt Counsellor will assess the financial position and lifestyle of the consumer and make certain recommendations so as to mitigate indebtedness.

The consumer has to understand that this is voluntary, consensual process which results in the Tribunal or Magistrate’s Court re-arranging the consumer’s financial obligations. The success of the process depends primarily on the willingness of the consumer to stick to the re-arrangement plan and to not incur any more debt by entering into any further credit agreements, other than consolidation agreement.

It is important that the consumer understands that debt counselling does not mean that he/she will not need to repay what is owed to the credit providers.

How the debt review process works and what the role of the Debt Counsellor will be:

- The consumer applies by completing a Form 16 or provides a debt counsellor with the relevant information stipulated in Regulation 24(1)(b).

- The debt counsellor informs the credit providers and credit bureaus of the application by updating the NCR’s DebtHelp system and issuing Form 17.1

- Then verifies the information provided by the consumer as well as the information received from the credit providers in the form of certificate of balances (COB).

- The debt counsellor assesses whether the consumer is over-indebted, or not. If the consumer is not over-indebted then the debt counsellor must reject the application as set out in section 86(7)(a) and update the NCR DebtHelp accordingly.

- Depending on the outcome, the debt counsellor then assesses whether the consumer is eligible for debt review or not. The credit providers and credit bureaus are informed of the decision.

- If the consumer qualifies to be placed under debt review, the debt counsellor sends out Form 17.2 to the consumer’s credit providers and credit bureaus and draft a debt restructuring proposal.

- After consideration of the debt restructuring proposal by the credit providers, the matter is referred to a Magistrates Court in terms of Section 86(8) of the Act or the Tribunal in terms of section 138 of the Act for an order declaring the consumer over-indebted.